Articles Articles |

Daniel R. Amerman, CFA, InflationIntoWealth.com

As the author of three books on mortgage finance and related derivative securities, and speaking as someone who first turned mortgages into rated securities in 1983, I’m going to let you in on an unfortunate little secret – the real subprime mortgage securitization crisis may not have even started yet. But, there is a good chance the real crisis will arrive soon.

This assertion that the crisis could just be getting started may seem absurd and extraordinarily out of touch. What about the approximately 45,000 homeowners losing their homes to foreclosure in the United States every month? What about the 8.9% plunge in nominal housing prices in 2007, the largest decline in over 20 years? What about Bear Stearns losing 94% of the value of its stock in 2 days, with even the remaining 6% in value being based on an unprecedented loan from the Fed before JP Morgan would agree to the acquisition? How much worse could it get?

To understand the full extent of the danger requires moving beyond current headlines to take a brief and simple look at how mortgage securitizations actually work. These securitizations are based on what are known as “stress tests”, or the ability of a security to withstand an adverse economic change and still pay principal and interest on schedule. The heart of the subprime problem is that no major stress tests happened in 2007 – and the market still blew up. Which brings up the question of what will happen to subprime and other mortgage derivative securities in 2008 if actual stress tests do occur in such possible forms as recession, increases in interest rates, or a further plunge in housing values? Given that the safety margins have already been stripped bare? As we will explore, should one of those stress tests occur – or worse, if two or three occur together – then we may look back at 2007 as being a mere stroll in the park in comparison.

To explain what I mean about nothing going wrong, let’s review a bit of ancient history, and talk about how ratings and securitized mortgages used to work. You started with a creditworthy borrower, and a significant piece of equity invested in the property. The assessment of “creditworthy” was not a guess or an experiment, but rather the result of decades of underwriting experience on a national basis, through good times and bad. With single family mortgages, you had a large pool of such creditworthy borrowers, each having equity in their properties.

Then, you applied what are known as “stress tests”. A stress test is the assumption that something goes wrong. For instance, you might assume that there was a recession that would lead to homeowners losing their jobs, and then their homes. If rising interest rates hurt the security, you would check out some rising interest rate scenarios, and if falling interest rates hurt the security, you would check out some falling interest rate scenarios. Essentially you would push on the security until it fell over (using financial modeling).

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

The rating was simply a description of how hard youhad to “push” before the security fell over and was unable to make contractual principal and interest payments to investors. If the ability to make payments was a bit shaky under the current economic environment, then the rating was junk. If the ability to repay investors was pretty good with a decent economy, but possibly grew problematic with a mild recession – then maybe you got the lowest investment grade rating, that of “BBB”. The highest rating, “AAA”, was reserved for those securities that had such powerful coverage and reserves built into them that they could withstand another Great Depression, and still make investor payments in full and on schedule. (Or so the theory went until Wall Street got collectively “brilliant” a few years ago.)

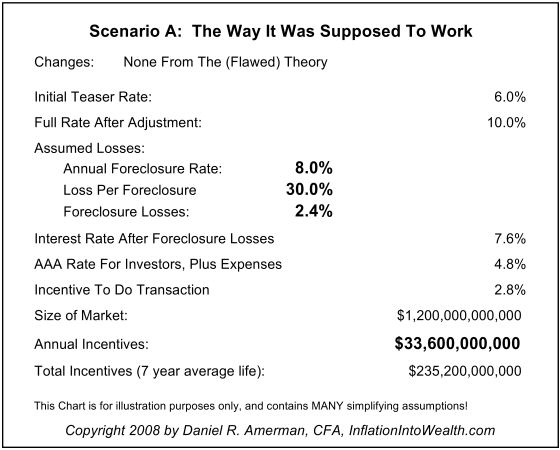

To understand how the subprime debacle came about, we need to understand the reasons why supposedly prudent lenders would lend money to people wanting to buy houses, who, unlike our examples above, had neither equity nor a good credit history. The essence of the theory is that you charge a high enough interest rate, then you can cover the losses, and still walk away with way more money than if you had been doing ye olde traditional and boring strategy of lending to credit worthy borrowers with actual equity in their homes. A simple version of the numbers is something like what is illustrated in Scenario A, “The Way It Was Supposed To Work”:

The theory was that if you lend to people who don’t have particularly good credit, and who didn't put much equity (if any) into their homes, then sure, foreclosures were going to happen, and at rates well in excess of national averages. In this case, for illustration purposes (there were many kinds of subprime mortgages securitized over the years, this is just one round number example), we are assuming that 8% of the mortgages go into foreclosure every year, and we assume that the loss per foreclosure is 30%, so there is an annual loss of 2.4% on a large pool of mortgages. If you were lending at the same low rates that a highly creditworthy borrower can get, then this 2.4% annual loss would be a bad thing. But, if you are lending at a rate that is much higher than the market for "good" loans, and through securitization, you can get most of your funding at “good” loan rates, (the 4.8% for “AAA rates” plus expenses in our example) – then that 2.4% annual loss is no big deal, and in fact leaves a lucrative amount of money for you and others to keep.

In our example of how things were supposed to work, that 2.8% annual incentive with a $1.2 trillion market worked out to over $33 billion a year in incentives to securitize subprime mortgages. This was money that would be split many different ways: mortgage banking fees, investment banking fees, high yields on junior classes for hedge funds and other aggressive investors, bond insurance payments, and some of the most lucrative rating agency fees (to assure investors the whole thing would work) that have ever been seen in the capital markets. Multiply times seven for an average mortgage life, and we're looking at almost a quarter of a trillion dollars to be split, much of it just for massaging some numbers on a computer.

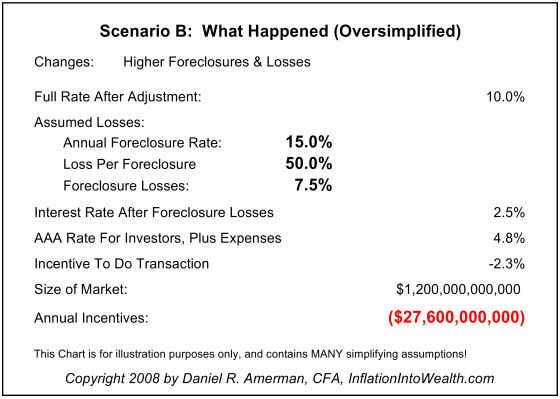

That was the theory, but there proved to be some complications in practice. The sources of these problems were myriad, including: underwriting people who could barely qualify for the teaser rate (while ignoring whether they could handle the full rate when the reset occurred); taking the thinnest of statistical histories, and creating a huge new market from the selective interpretations that allowed the deals to get done; ignoring the due diligence reports if you didn’t like them, and a number of other reasons that could all be summed up as the intersection of hubris and greed. The reasons are not our focus in this article, but a simple illustration of a general result is included below (this is an illustration, and does not purport to be an accurate statistical summary of the current market):

As illustrated in Scenario B, if it turns out that foreclosures are 15% instead of 8% for a particular grade of subprime, and foreclosure losses rise to 50% from 30% because so many people are getting foreclosed upon that it drives home prices downwards – then instead of splitting 2.8% of the excess profits in each mortgage pool, the big financial players are splitting a 2.3% loss. Meaning $27 billion in annual losses instead of $33 billion in profits (in this illustration, which does not purport to be an industry summary). While bad enough on its own, the losses showed that the securitization didn’t work, the ratings didn’t work, and the bond insurance might not work either. Which then collapsed the prices in the market to a far greater extent than mere foreclosure losses to date would justify alone, as discussed in the “Leveraging Up The Losses” section of this article.

The higher than expected losses did something else as well, something that truly made sophisticated investors nervous. Because the system failed with no genuine stress tests, and the layers of protection that were intended to insulate investors against adverse economic changes melted down – investors were left naked and exposed. Vulnerable to any adverse changes, as we illustrate in the next four charts below.

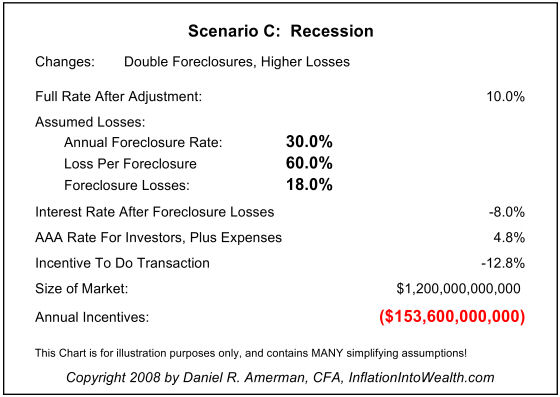

In Scenario C above we assume that a recession hits, something that is almost certainly already happening. People in marginal economic circumstances tend to be the most vulnerable to recessions, and there are already a surplus of properties on the market. So if we assume that a recession doubles subprime foreclosure rates, from 15% to 30%, and increases the loss per property from 50% to 60% as still more homes hit the market, (banks lose far more money in a foreclosure than just the decline in overall property values would indicate), then because we have no safety layers left, all the negative results go straight to the bottom line. Meaning that losses just went up by a factor of five, with over $154 billion in losses in the first year. In other words, what we saw in 2007 was nothing compared to what 2008 may hold for investors if a recession hits the nation. (Please note these are illustrations rather than precise predictions, a mild recession might inflict less losses – and a severe recession much worse.)

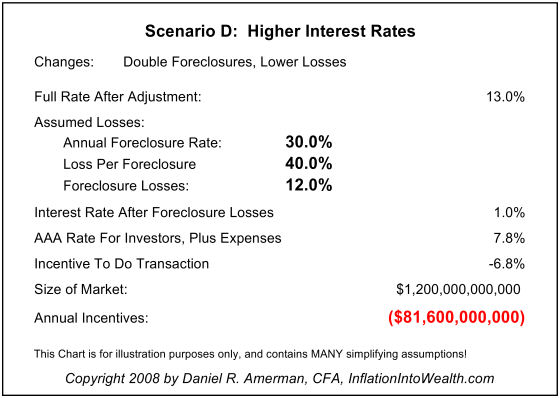

Recession is not the only danger. We just experienced the highest inflation rates in 17 years with an official annual CPI rate of 4.1% in 2007, and a 12 month PPI rate of 7.4% through January of 2008. Substantial inflationary dangers remain, and the Fed has effectively abandoned its (already weak) defense of the dollar, in order to try to avert recession. In Scenario D we look at what happens if recession is (miraculously) averted – but the price is a surge in inflation and rapidly increasing interest rates. Let’s say that indexed subprime mortgage rates jump from 10% to 13% -- and the result, for a group of people who barely qualified at 6% interest rates, is that the foreclosure rate doubles, going from 15% to 30%. With this scenario, rising inflation alleviates the fall in property values, so we assume that the average loss declines from 50% to 40%. Nonetheless, our bottom line is that our overall losses from subprime mortgages have tripled, from $27 billion up to $81 billion. The very effort of avoiding or minimizing a recession (if possible at all), may trigger a loss that is almost as bad as the recession driven loss would have been.

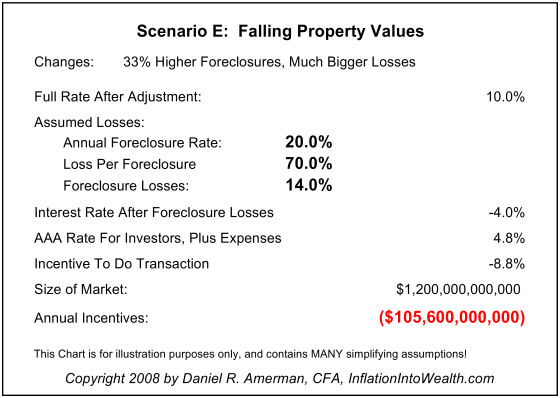

OK, let’s be optimists. Let’s say that the Fed somehow balances on the tightrope and dodges major recession through pumping the system full of new money, without triggering higher levels of inflation. This will be amazing if they can pull it off – but stranger things have happened. However, there is the separate issue of another powerful economic force at work, and that is housing prices that probably got way too high in a number of areas, and which many economists think might be in for a prolonged fall. If this happens, then two major problems occur for subprime mortgage collateralized securities investors: the foreclosure rate rises, because the more negative home equity becomes for someone who is struggling to make payments, the more likely they are to say “forget it” and walk away from their property; and, following that (of course), the greater the losses per foreclosure for investors. As illustrated in Scenario E above, if we say that the foreclosure rate rises from 15% to 20%, and in a market of falling values where few want to buy, the average foreclosure loss rises from 50% to 70%, then our annual total losses increase to $105 billion, or almost four times the current loss level under current conditions.

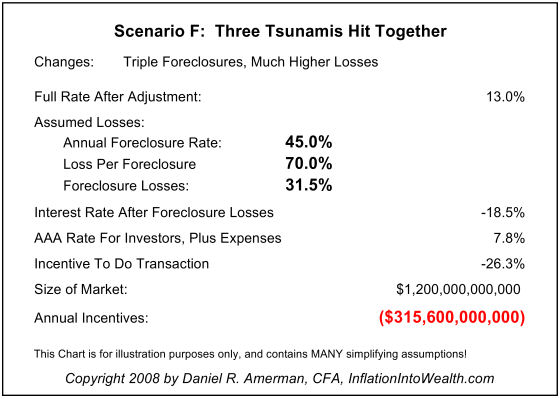

So, recession pushed our losses up by five times in our recession illustration (Scenario C), rising interest rates pushed up our losses by three times in Scenario D, and falling home prices pushed up our losses by four times in Scenario E. What if all three scenarios happen at the same time? What happens if: 1) a significant recession does hit despite the Fed pumping the system full of money; 2) inflation does increase thanks to the Fed’s recession fighting efforts, meaning we now have stagflation; and 3) the drop in property values accelerates with the double whammy of people losing their jobs even while mortgages grow less affordable in markets that are still falling?

Or, if we want to look on an individual level, what happens to the chances of someone making their mortgage payments, when: 1) they lose their job; 2) their mortgage payments more than double in two years (since the initial teaser rate); and 3) they owe $50,000 more on their mortgage than the market value of their home?

Troubles can arrive in threes, and the triple whammy of recession, rising interest rates and falling property values can indeed come ashore one after another, like three great tsunamis hitting a beach, as illustrated above in Scenario F. Let’s assume this three way combination means that foreclosure rates triple from 15% to 45% -- which may be a bit conservative for subprime borrowers, none of whom ever really had the money for the home in the first place, under conventional lending standards. Let’s further say that the glut of distressed homes on the market, even as unemployment is spiking upwards and mortgages are growing both less affordable and less available, means that the fall in property values accelerates, and average investor foreclosure losses rise from 50% to 70%. As shown in Scenario F – just making those two (reasonable) changes to our assumptions means that subprime losses climb from $27 billion to $315 billion, an increase of almost twelve times!

Should stagflation slam into an overpriced housing market after investor safety layers have already been stripped away, then we haven’t even begun to see the full extent of the damage to investors, to the housing market, and to the financial system as a whole.

The scenarios shown herein may seem overly optimistic, particularly when compared to such numbers as the $600 billion in industry losses which UBS is predicting, or the $160 billion in losses which they estimate to have already occurred. The reason for the discrepancy is that we have been sticking to just the mortgages and mortgage securities – and these securities are generally not bought with cash, rather they are bought with borrowed cash. Highly volatile, short term borrowings which carry major risks of their own. As an example, when Bear Stearns fell 94% in 2 (weekend) days, there was no change in the mortgage market that precipitated the fall – it was the fear that Bear Stearns would lose their ability to borrow. An event that can make the capital of just about any seemingly solid looking major bank or investment bank disappear in a flash.

The bigger issue is that all the big financial players are highly leveraged. Now, just for round numbers, let’s say that a big financial firm has $100 billion in assets, $94 billion in liabilities and $6 billion in capital. We will assume that it owns $6 billion in questionable mortgage securities directly, with another $6 billion in loans to highly leveraged hedge funds that have their own questionable mortgage security holdings. Something drops the value of questionable mortgage securities by 25%. So the big financial firm takes a $1.5 billion hit directly – and a 50% hit on the hedge fund loans when the hedge funds collapse and the creditors are left with illiquid and distressed collateral that they don’t dare sell. The big financial firm just lost $4.5 billion, and the key number isn’t that it lost 4.5% of the value of its assets – but that it lost 75% of the value of its $6 billion capital base. With the remaining 25% being considered highly questionable.

Meaning the financial firm now has to unload $75 billion in assets to maintain its 6% capital ratio (assuming it can survive at all), or else be recapitalized by a foreign investor, with the Fed possibly propping it up in the meantime, when no one else will lend to it. In a market where everyone else has their own problems, and don’t have the money to buy the assets. Which drops the prices of everything. Which multiplies the losses upwards. Which brings us to the real problem.

If real subprime losses climb by 6 times or 12 times – then system wide financial losses likely climb by 24 times, or 36 times, or more. Because everything is linked, and the math that links all the dominos is multiplication, not addition. If you want a mental picture of how banking dominos work, don’t think of one domino hitting another domino, hitting another domino in a long line. Rather, think of one domino hitting two dominos, hitting four dominos, and so forth. Understand this, and you will understand the desperation in the current moves by the Federal Reserve.

Will this disaster scenario that we've just outlined actually happen? I sure hope not, for all of our sakes. Perhaps the easiest thing to do is to write off this article as being some wildly pessimistic fantasy. Hopefully it is. Except, we have to face some inconvenient facts. The subprime market really did melt down in 2007. The so-called financial masters of the universe really did make some spectacularly stupid moves, really did nearly go broke and are having to turn to foreign investors and Federal Reserve interventions in order to survive. Those rocks of stability and security in the financial system, the bond insurance firms and rating agencies, really did turn out to have foundations of sand rather than foundations of stone.

Most people agree we really are entering a recession. Inflation really was at its highest level in 17 years in 2007, which could also easily turn into much higher interest rates. The word stagflation really is being spoken by increasing numbers of people. Housing values really are dropping in a number of major markets. The safety margins that protected subprime mortgage derivatives investors really did collapse, even without any major economic stress test – and up to three major stress tests may actually hit this already badly wounded market in 2008. Is what we are describing here really paranoia – or is it what is happening all around us?

When we put all these unfortunate facts together, wemay not know for sure whether any disaster scenario is going to happen -- but I think we all have to agree that there is a significant chance that it just… might happen. Now let's further stipulate that the very essence of financial prudence, of wisdom, of protecting your savings is to be prepared for very real possibilities. If you’re not sure, but you think something just might happen in the next year which could devastate your life savings – I think most of us feel a responsibility to try to protect ourselves, if we can. Which takes us to perhaps the most important part of this article -- how can we be prepared?

First, you need to very seriously think about cutting your ownership of financial assets. The type of disaster scenario we are talking about could devastate stock and bond markets for a generation. If you are investing for retirement and your portfolio gets taken down by just such a scenario, then you may never have the chance to replace it. For these reasons, there is a powerful, powerful case for moving a substantial portion of your assets into tangible assets. Good examples of tangible assets include gold, silver, commodities, real estate, farmland and energy.

The next thing you should very seriously think about is whether crisis leads to opportunity, in ways that go well beyond a simple strategy of only buying tangible assets. John Paulson saw the crisis that was coming in subprime mortgages, researched and educated himself on this area (which had not been his field of expertise), and he turned the crisis into a $3-$4 billion personal payday in 2007. If you're not a hedge fund manager like Paulson, you may not have the tools that he used to turn a market crisis into personal billions. That’s OK, because Paulson didn’t start with the tools either. He started with educating himself, learning about a new area, until he came up with a novel way to profit from disaster. A method that wasn’t in the financial textbooks, and that he didn’t find by reading a financial columnist in the paper.

You have more tools than you may think, some of which may surprise you. Tools which can give you the opportunity to turn financial disaster into personal net worth. There are ways you can use those tools to turn the destruction of the currency into perhaps the greatest real wealth-building opportunity of your life, on a long-term and tax-advantaged basis. But, if you want this to happen --you will need to start with learning. You are going to have to educate yourself, and work to not just understand, but to master some of the financial forces and methods in play here. You will have to learn how to turn the destruction of paper wealth into real wealth. With Turning Inflation Into Wealth being the first key step. My best wishes to you for turning this challenge into an extraordinary personal opportunity.

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will redistribute real wealth to you, and the higher the rate of inflation – the more your after-inflation net worth grows? Do you know how to achieve these gains on a long-term and tax-advantaged basis? Do you know how to potentially triple your after-tax and after-inflation returns through Reversing The Inflation Tax? So that instead of paying real taxes on illusionary income, you are paying illusionary taxes on real increases in net worth? These are among the many topics covered in the free “Turning Inflation Into Wealth” Mini-Course. Starting simple, this course delivers a series of 10-15 minute readings, with each reading building on the knowledge and information contained in previous readings. More information on the course is available at InflationIntoWealth.com

Contact Information:

Daniel R. Amerman, CFA

Website: http://InflationIntoWealth.com/

E-mail: mail@the-great-retirement-experiment.com

This essay and the websites, mini-course, books and audio recordings, contain the ideas and opinions of the author. They are conceptual explorations of general economic principles, and how people may – or may not – interact in the future. As with any discussion of the future, there cannot be any absolute certainty. What this website does not contain is specific investment, legal or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the website, pamphlets, recordings, books and other products, either directly or indirectly, are expressly disclaimed by the author.