Can A Nation $18 Trillion In Debt Afford Higher Interest Rates & Will This Change Our Retirements?

For some years now, very low interest rates have been reducing the earnings of retirement investors as well as the lifestyles of many of those already retired. To understand why this has been happening – and why it may continue for a very long time – one must recognize that there is a direct relationship between the interest rates that are paid to savers, and the interest payments made by a heavily indebted federal government.

For a retirement investor who is currently earning a 1% interest rate, a 5% increase in rates to a 6% return would increase their total investment earnings by 1,263% over 30 years, allowing for a radical improvement to their eventual retirement standard of living.

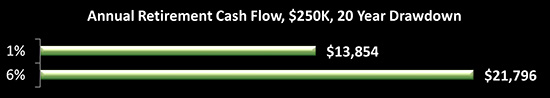

And for a current retiree who is drawing down their investment portfolio over 20 years, a 5% increase in annual interest rates from 1% to 6% would allow them to raise their standard of living by a full 57% in each and every one of those years.

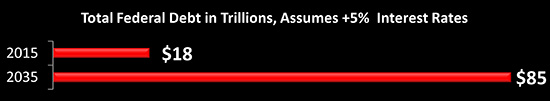

For the United States government, on the other hand, a 5% increase in interest rates on the national debt would raise the annual deficit by about $900 billion per year. Because the government borrows the money to make interest payments, this could set off a chain reaction of paying interest on money borrowed to pay interest, leading to a national debt increase of $67 trillion in 20 years (absent major tax increases).

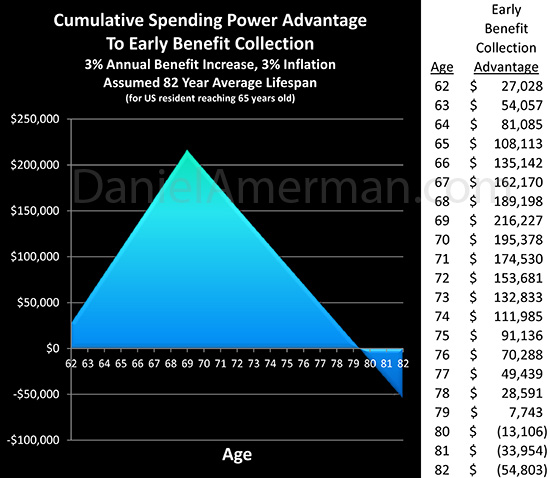

Why Early Collection Of Social Security Benefits Can Be The Best Choice

Recently, there has been quite a bit of publicity about studies showing that for a retiree who lives to an average age, there is a six figure advantage to waiting until age 70 to begin the collection of Social Security payments. That is an amazing advantage ─ but does it hold up under close scrutiny?

As we will explore herein, once we "raise our game" a bit, and use a more sophisticated type of financial analysis than some of the very simple Social Security decision aids in wide circulation ─ the results can turn upside down. That is, for many millions of people, the financial case for early collection of benefits is much stronger than is commonly recognized.

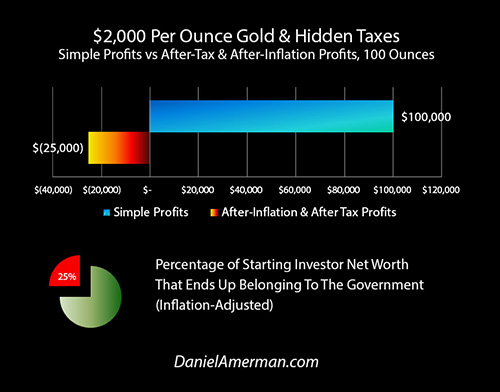

Hidden Gold Taxes: The Secret Weapon Of Bankrupt Governments

What if there were a hidden tax that most gold and silver investors were simply unaware of? A tax where the government would take a big chunk of your starting net worth if gold went to $2,000 an ounce, leaving you poorer than you started with? And a tax that rises with inflation, so that $100,000 an ounce gold could cripple your net worth?

This tax already exists, as we will demonstrate in step by step detail using three easy to follow examples. All but a few investors are unaware of this tax and its devastating implications. Simply put, when we assume that gold acts as “real money” and perfectly maintains its purchasing power during rapid inflation, then the higher that the rate of inflation rises, the higher the percentage of the average gold investor’s starting net worth that ends up belonging to the government.

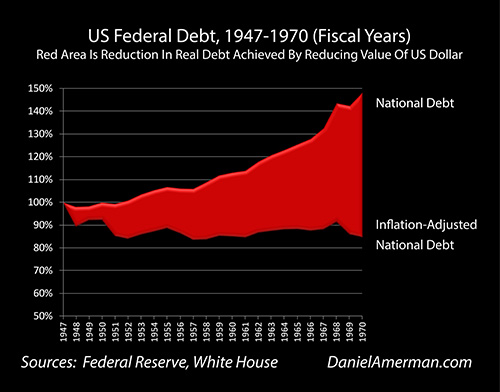

Is There A “Back Door” Method For The Government To Pay Down The Federal Debt Using Private Savings?

The United States government is currently about $18 trillion in debt, which is roughly the size of its annual economy. When it comes to savings and investment decisions, the most common way of dealing with this problem – is to completely ignore its existence. As if to say that this wasn't anticipated in the usual financial planning models, and it looks quite bad, so we will all just pretend it doesn't exist.

For understandable reasons, the national debt seems somewhat abstract to most people. But what history shows us is that how nations reduce debts is deeply personal and even life changing for the individual citizens of that nation. For this has happened before in one form or another many times in many nations over the centuries, and we know that each time the national debt is repaid or otherwise reduced – the personal lives of the people are changed, sometimes dramatically.

Participation in this process in not optional, it is mandatory, and pretending it does not exist – offers an individual no protection whatsoever.

One real world historical example is what happened with the United States between 1947 and 1970, where the federal debt appeared to grow to 148% of where it started, but the inflation-adjusted value of the debt actually fell to 85% of where it began. This method for effective debt reduction dominated interest rates and bond markets for decades, and every saver in America helped to pay through a steady decline in the value of their money.

While there are unique aspects to the current situation – the basic set of tools for reducing national debts remains the same.

Listed below are the four primary methods which nations use in practice to pay down huge government debts when they have borrowed in their own currency. Which particular method the government chooses could end up being the number one determinant of the value of your savings, as well as your long-term financial security.

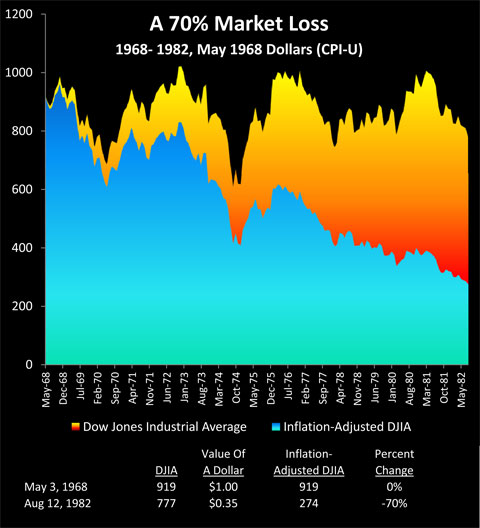

Deadly Dow 36,000 & The Secret History Of A 70% Market Loss

Some investors fear that the Dow could plummet to 4,000 or 5,000. And surely that would be bad. However, there is actually a worse possibility to consider, which is the Dow going to say 36,000 instead. Now, Dow 36,000 may sound like a "problem" that most investors would love to have! So what's the danger?

To demonstrate why Dow 36,000 could be a nightmare scenario, we will begin with a review of how 70% of stock investor wealth was annihilated when the US endured a combination of sustained high unemployment and high rates of monetary inflation. Using a series of simple steps, we will pierce through the generally accepted but false narrative about that market, and show how even with an assumption of "perfect" market timing - that is, buying on the best single day over a near 12 year period, and selling on the best single day over an almost 10 year period - that the historical end result was still crippling investor losses, caused by three distinct wealth-destroying forces.

We will then move to today's financial world, and show how the little understood interplay between these same three deadly wealth destroyers could create the glittering illusion of wealth that would be Dow 36,000 - even while wiping out over 60% of real investment values.

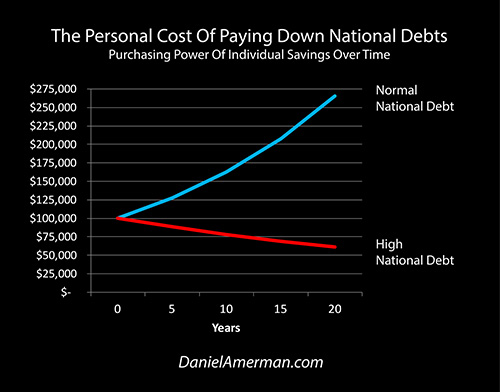

The Personal Cost Of Paying Down National Debts

There is a well-accepted formula for how heavily indebted governments can slowly reduce the effective size of their national debts, which does not involve raising taxes or cutting spending – but nonetheless carries a heavy price for individual savers.

The blue line in the above graph shows how the average person can ordinarily build wealth through saving and letting their money work for them. With the passage of time, there is a steady increase in both their wealth and their financial security. The blue line represents normal market conditions, and typical interest rates when governments are not heavily indebted.

The red line represents the current situation for the US and other nations over the last several years, and shows what happens to the actual purchasing power of individual savings when a government is heavily in debt. Which is that on average, savers slowly lose real wealth, and the more time that goes by, the greater the loss and the less the financial security.

What that red line shows is the quite personal impact of something vast and otherwise impersonal – which is governments creating what macroeconomists refer to as negative real interest rates. As is being done as a matter of stated policy right now in many places around the world including the United States, Europe and Japan.

Few people aside from economists and financial professionals are aware of this policy, let alone how it works. Yet, because it dramatically changes investment results for the entire nation, it is already affecting how much wealth you build, and may have a powerful impact on when you personally retire as well as what your own standard of living will be in retirement.

In this resource we will walk through a series of simple financial examples to close that knowledge gap, so that you will have the information you need to understand the very personal implications for your own life now and in the years to come.