Articles Articles |

By Daniel R. Amerman, CFA

InflationIntoWealth.com

If the United States government was an individual or corporation, and we looked at the obligations it has entered into for the decades ahead – it would be bankrupt. However, the federal government is not an individual or corporation, and has powers that make these bankruptcy analogies quite dangerous for investors who take them to heart. Thinking the United States may go bankrupt means focusing on a danger that isn’t real, while missing the dangers that are real – which are the methods the government can use to avoid bankruptcy, and the devastating impact of those methods upon retirees, salaried workers and many investment strategies.

The government’s effective immunity from bankruptcy can be found in two separate but related governmental powers: 1) the government controls the money supply, meaning it controls the degree of inflation (in broad terms); and 2) the government also controls the official inflation indexes. Many people are aware that there will likely be a major squeeze coming up that means future beneficiaries will receive much less than current beneficiaries in purchasing power terms. The contribution of this article is to flesh out how the specifics can work, and demonstrate how through steady and somewhat hidden pressure, the value of promises can be gradually stripped away even as a generation of retirees is impoverished. We will use a fairly simple example based on two widely known current inflation figures, to illustrate how through the manipulation of both inflation and inflation indexes, the government can simultaneously repay existing government obligations at 15 cents on the dollar, while repaying inflation-protected promises (in full) at a mere 27 cents on the dollar.

To explore how this process can work – and just how powerful the government’s incentives are for manipulating inflation indexes – we need to pick assumptions for index inflation and actual inflation. For the index, we will use current official government statistics, and compare the Consumer Price Indexes for October 2006 and October 2007. The twelve month increase in price levels was almost exactly 3.0% (120.7 / 117.2 = 1.0299, interim numbers as of 12/07).

When we look at what has happened to the prices for food, energy, housing prices and medical insurance over the last several years, there are many Americans who are having trouble believing the government story of an official 2%-3% per year. Therefore, for exploration and illustration purposes, we will use a nice, round 10% assumption as the true rate of inflation. John Williams of ShadowStats.com has made a case for this figure being the true rate of inflation, when inflation is calculated using the same methodologies that were used by the government in the 70s and 80s.

A belief that the government does or would systematically deceive its citizens to serve political interests is incidental to this article. It is up to the reader to decide whether we talking about what is happening now – or what could be happening in the future. The numbers work the same way whether the inflation and index-manipulation is openly admitted, fraudulently hidden, obfuscated behind layers of statistical complexity and technical jargon – or some combination thereof.

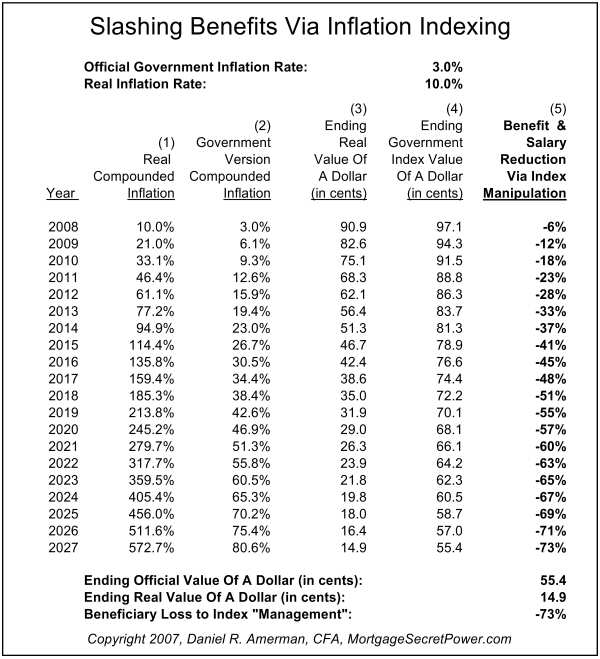

When we combine the assumptions of an official index that grows at 3% per year, while real inflation grows at a rate of 10% per year, then we get the chart below.

A sovereign nation dealing with excessive promises denominated in it’s own currency does not face an impossible problem, and the solution is not even a mystery – “print the money” as needed, which slashes the value of the currency, and the magnitude of the problem is slashed along with it (along with the value of the life savings of the nation’s citizens, unfortunately, but such is the true nature of currency). This government power to pay promises through inflation is illustrated in the “Ending Real Value of a Dollar” (column 3). As would be expected with a 10% rate of inflation, the value of a dollar plunges. It is only worth 75 cents after three years, 50 cents within 7 years, and is down to only 15 cents by the end of 20 years. This destruction of the value of the dollar is an entirely legal means of reneging on the government’s debts, and effectively allows it to walk away from ever paying for past deficit spending, both domestically and internationally. Those massive trade deficits which were covered by other nations buying US Treasury bonds will never likely be repaid, in other words.

The “problem” from the government’s perspective with simply slashing the value of the currency, is that it has been slashed before, the citizens are aware this can happen, and many (though not all) retiree benefits are inflation-indexed, along with (effectively) the incomes of many millions of employees whose contracts are tied to the CPI. Making the real value of a dollar worth a dime doesn’t help if all the wages and benefits rise from a dollar to ten dollars in response.

The government has a loophole when it comes to making inflation indexed payments, however, and it is a massive loophole: there is no such thing as a general inflation rate for a nation, it’s more of a theoretical construct. An enormously complex theoretical construct that is highly subjective, and even well-intentioned economists may vary substantially in their estimate of what the effective rate of inflation is for a nation. So much is dependent on the “basket” of goods and services chosen to track, as well as the particular methodologies and assumptions that go into the index itself. What we call the “inflation rate ” then is therefore both quite subjective and subject to political manipulation. Which is another way of saying that the true definition of the inflation rate for government promises, is not about complex economic calculations at all, rather, the index is whatever the government says it is.

In the chart above, we follow what happens when the government chooses to interpret complex economic data in such a way that the official inflation rate is 3%. When we look at the “Ending Government Index Value Of A Dollar” (column 4), then we can see that the government says that a dollar is worth 91 cents after three years, 81 cents after 7 years, and 55 cent at the end of 20 years. There is obviously quite a difference between our real rate of inflation, and the official government version, and that difference is shown in percentage terms in column 5, “Benefit & Salary Reduction Via Index Manipulation”.

When we look at year 1, we can see that the ending real value of a dollar is 90.9 cents – but the official government index says that a dollar is worth 97.1 cents. The difference between the two is 6%, and that represents the savings to the government from manipulating the inflation index. Just to use round numbers, if the government owes $1,000 billion ($1 trillion) in inflation-indexed wages and Social Security payments, when expressed in 2007 dollars, and the official government inflation index for 2008 is 103, then the government pays $1,030 billion. However, a dollar is actually only worth 90.9 cents (column 3), so what the government pays out is only $936 billion in real (inflation-adjusted) dollars ($1,030 X 90.9%), which is $64 billion less than what was promised. In other words, the combination of using both inflation and a manipulated inflation index allows the government to pay out what looks like $30 billion more than the year before – and will appear to be $30 billion more in the newspapers, the budget and the checks disbursed – but will actually be $64 billion less.

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

This difference between the façade and the realthen grows with each year. Sticking with our example $1 trillion in 2007 dollars, by 2012 the façade will be that the government is paying out $1,159 billion [$1 trillion X (1 + column 2)], as reflected in retiree and employee paychecks, government budgets and newspaper reports. However, in purchasing power terms, by 2012 a dollar will only buy what 62 cents did in 2007 (column 3). So the real dollar cost of what the government is paying out is in fact down to only $720 billion ($1,159 X 62.1%). In five years, despite the appearance of paying out $159 billion in increased benefits, the government can use its combined powers over both inflation and inflation indexes to reduce real benefits by 28% (column 5), or $280 billion. (If we compare what the public will see ($1,159 billion) compared to what is really being paid ($720 billion) then the difference is an even more dramatic $439 billion.)

The above could be considered mildly complex, and my apologies if the specifics were a little difficult to track. The mild complexity is a necessity, however. For in this mild complexity lies both the heart of the opportunity for the government – and your main defense as an individual. Because this powerful one-two combination of controlling inflation and controlling inflation-indexing is about mathematics and economics – it isn’t easily reducible to a sound bite. The higher the percentage of the population that doesn’t fully understand what is going on – the better the strategy works from a political perspective. Conversely, if you are to defend your lifestyle and savings (and you do have strong defenses available, as we will discuss below), then knowledge is your first and irreplaceable line of defense.

The vital nature of understanding this complexity becomes even more clear when we look ahead to the crucial years of 2017 and 2027. The year 2017 is the year when the government projects that Social Security payments will exceed Social Security taxes. A very big problem – that may not be such a problem after all, if the government is effectively paying out only half in real terms of what has been promised to Social Security beneficiaries. As shown in column 5, the combination of 10% inflation and 3% inflation indexes would indeed produce a 48% savings for the government by 2017.

The year 2017 is a problem, but it is by 2027 when things truly become impossible from a governmental perspective – if a dollar is worth a dollar. For the years 2027-2029 are the crest of the Baby Boom’s retirement, representing the time when the greatest numbers of Boomers have retired, but before expected mortality has brought the total number of retirees down. This is the time when we reach the central problem of only two adults of working age for each person of retirement age. An unaffordable impossibility for our current Social Security and Medicare structure – unless we have both inflation and inflation index manipulation. In that case, as shown in column 5, the real cost of meeting promises will have been reduced by 73% -- making the impossible into the possible.

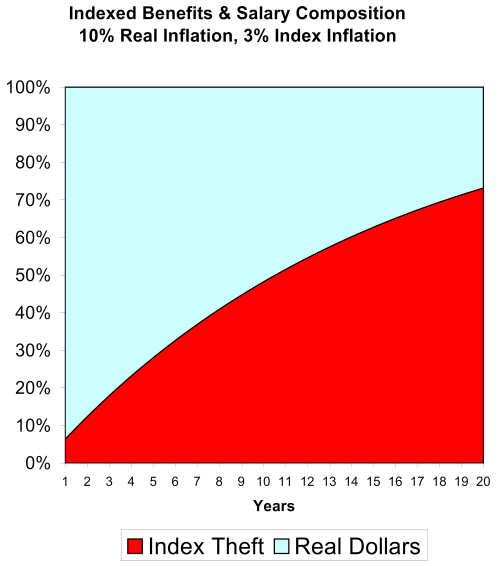

There is a cost to the government’s need to turn the impossible into the possible: a steady impoverishment of the people who are owed the inflation-indexed payments. This impoverishment is illustrated in the graph below:

What the chart illustrates is the composition of inflation-indexed payments to workers and retirees. The light blue represents purchasing power, and the red represents loss of purchasing power. If the inflation index were to keep up with inflation – as promised – then there would be no red, the entire chart would be light blue. However, when indexes don’t keep up with actual inflation, the government’s gain is directly paid for out of retiree and worker pockets. This theft by index management starts at 6% (the red equals column 5 from the chart), and steadily builds. A little more than a quarter of the purchasing power of benefits and salaries has been taken in 5 years, about half in ten years, and three quarters is gone in 20 years. For the inflation-indexed retiree or worker, the red zone is the steady loss of purchasing power, and therefore loss of lifestyle, as real income steadily declines even while giving the semblance of increasing in exact step with inflation.

It is a steady breaking of promises, in year by year increments, that systematically impoverishes the elderly, as well as all workers whose salary increases are tied to the inflation index (which includes almost all government employees). In their hearts, many Boomers already know that they won’t be collecting anywhere close to the benefits that their parents received, as do the generations behind them. What the graph above illustrates is the precise and steady, year by year method, in which most of the purchasing power of retiree promises (including inflation-indexed pensions as well as Social Security) can be destroyed before most of the promises are paid.

Will what is shown above really work for 20 years? Probably not entirely by itself, or without the population at large becoming at least partially aware of what is going on. However, the options are limited for closing impossible gaps. Taxes can only be raised so high, and then it comes down to benefit cuts. The more above board and open the cuts in benefits and salary – the greater the political damage. The harder the changes will be to enact, and the more politicians voted out of office. On the other hand, inflation and inflation indexing are subtle and difficult to understand, relative to openly raising taxes or openly slashing benefits. Complex and subtle helps politicians stay in office, and assuming politicians want to stay in office – do you think they will refrain from trying the subtler approach again and again? Repeatedly making the choice to stay in office until the end results are anything but subtle?

Notice that this indexing “management” strategy has some quite beneficial side effects as well. Incomes are always rising, so there is no excuse for the population not to go out and spend -- even if they have been feeling a bit mysteriously strapped for funds lately, and need to put it on the plastic. The stock indexes are always setting new records, even in the unlikely case that the newspapers start adjusting for inflation. Of course, most importantly of all, the unending supply of good news helps keep politicians in office. What do you think the politicians will choose? Is your portfolio and retirement protected against that choice? If you are relying on an inflation-indexed salary or pension – do you have an investment plan for covering the red zone in the graph, during a time when high inflation is shredding the value of conventional financial assets?

Can you really fool all the people with a combination of inflation and inflation index manipulation? Some might say “No way! People are way too smart for that, and the professors and media would quickly expose the fraud.” Interesting thing though… 40 years ago, one working adult earned enough to support a middle class household of five or six, including a stay-at-home spouse and three or four kids. Today, normal seems to be defined more like 2 working adults for every middle class household with 1-2 children. True, the houses are bigger, the color TVs are bigger, there are two cars, they are better cars, people eat out more and travel more, etc, etc. But, as we’ve gone from one worker to support 5-6 people, to one worker to support 1.5 to 2 people… did you ever wonder how accurate that indexing has been in practice?

It isn’t reported as such, but arguably the inflation index is one of the most important political statistics. It determines everything from the economic growth that is reported, to the benefits that are paid out, to budget deficits and surpluses, and whether taxes need to be raised. Indeed, the difference between prosperity and recession – as reported in the papers – can be no more than 2-3% in the inflation index, as economic growth is net of inflation indexes. Such complex calculations as well, not understood by either reporters or the public, performed in obscurity – but watched with keen attention by the political appointees, who know exactly what it will take to win the next election.

There is not even a need for a “conspiracy”, or a group of politicians meeting in secret and deciding to defraud the public. Human nature, time and overwhelming incentives are enough to gradually make real what we have illustrated in this article. Political appointees know how to reward those government employees who can find a way to rationalize dropping the rate of growth of the index by 0.2% here, and 0.02% there. If as an employee you want to get promoted – that is what you do. Which creates an environment of decades of incentives leading to decades of incremental changes, steadily moving the standard as the changes add up. Human nature being what it is, what do you think happens? Has already happened? Will happen when the political motivations reach all new levels?

The problem for retirees, inflation-indexed workers and general investors is that the above strategy works like a charm from a governmental perspective. Indeed it works better than any other alternative from a political perspective, as it allows much of the damage to be hidden behind statistics and economists, even as promises are legally kept, while being broken in substance. The façade of making inflation-adjusted payments in full just won’t work, the government would have to go bankrupt – and the government has no intention of going bankrupt. It is therefore incumbent upon thoughtful investors invest in such a way that they protect themselves from the actions the government will take in avoiding bankruptcy. This means preparing not only for a likely environment of high and sustained inflation that destroys the value of financial assets – but for a real inflation rate that may be substantively higher than what you will be reading about in the paper.

It also means that if you have substantial future income that is inflation-indexed – you are likely not fully protected from inflation. That there is a good chance you will get your inflation-indexed future payments in full as promised, but those rising payments will steadily buy less with each passing year. Which means that if you want to maintain your planned standard of living – you will need to find a way to offset the steady spread of the red in the preceding graph. What you need most is a targeted financial strategy that focuses on profiting from inflation.

Whether you are a general investor or inflation-indexed beneficiary, the first and most obvious step is to choose to invest in the reality of tangible assets rather than symbols. These tangible assets could be gold, silver, real estate, energy or farmland, to name some of the most prominent examples.

In combination with the tangible asset step, there is a second step to take as well, whether you are a Boomer, or older or younger – and that is to gain the knowledge you need to protect yourself, and even turn adversity into opportunity. This will mean looking inflation straight in the eye and saying: “Inflation, you are likely to play a big role in my personal future, and instead of ignoring you or thoughtlessly flailing away at you – I will study you and your ways. I will learn the deeply unfair ways in which you redistribute wealth, and the counterintuitive lessons about how some investors will be destroyed by inflation and repeatedly pay taxes for the privilege, even while other investors are claiming real wealth on a tax-free basis. I will learn to position myself so that you redistribute wealth to me, and the worse the financial devastation you wreak – the more my personal real net worth grows. I will examine the official blindness to inflation within government tax policy that creates the Inflation Tax, and instead of raging or despairing, I will understand that a blind opponent is a weak opponent, and I will take advantage your blindness and use tax policy to multiply my real wealth.”

It truly does boil down to common sense. The impossible is approaching fast, and we each have the choice of positioning ourselves so that our financial well-being depends on impossible promises being kept – or positioning ourselves so that we will profit from those impossible promises being broken. As you decide, do keep in mind that some of the most lucrative long-term and tax-advantaged opportunities to profit from inflation that have been available for decades can be found right now, but, by the time resurgent inflation dominates the headlines – the easy arbitrage opportunities will be long gone.

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will redistribute real wealth to you, and the higher the rate of inflation – the more your after-inflation net worth grows? Do you know how to achieve these gains on a long-term and tax-advantaged basis? Do you know how to potentially triple your after-tax and after-inflation returns through Reversing The Inflation Tax? So that instead of paying real taxes on illusionary income, you are paying illusionary taxes on real increases in net worth? These are among the many topics covered in the free “Turning Inflation Into Wealth” Mini-Course. Starting simple, this course delivers a series of 10-15 minute readings, with each reading building on the knowledge and information contained in previous readings. More information on the course is available at InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://InflationIntoWealth.com/

E-mail: mail@the-great-retirement-experiment.com

This essay and the websites, including the

readings, pamphlets, books and audio recordings, contain the ideas and opinions

of the author. They are conceptual explorations of general economic

principles, and how people may – or may not – interact in the future. As

with any discussion of the future, there cannot be any absolute

certainty. What this website does not contain is specific investment,

legal or any other form of professional advice. If specific advice is

needed, it should be sought from an appropriate professional. Any

liability, responsibility or warranty for the results of the application of

principles contained in the website, readings, pamphlets, recordings, books and

other products, either directly or indirectly, are expressly disclaimed by the

author.