Articles Articles |

Daniel R. Amerman, CFA, InflationIntoWealth.com

In Part 1 of this series on Puncturing Deflation Myths, we reviewed three logical fallacies, and showed why the US Great Depression didn’t prove the case for monetary deflation, but rather provided historical proof of how a sufficiently determined government could break monetary deflation at will, even in the midst of depression. In this Part II we will uncover three more logical fallacies as we:

1) Revisit our central question with regard to widespread theories about rapid and uncontrollable price deflation threatening symbolic currencies (“when has it ever happened in the real world?”) and review what actually happened with modern Japan;

2) Show the true peril experienced by Japan over the last 20 years, which is not monetary deflation but the much more deadly asset deflation;

3) Uncover the extraordinarily dangerous logical fallacy that results from confusing the two types of deflation, and show how this fallacy is currently leading millions of investors to mistakenly believe the value of their money is protected by bad economic times – when it has no protection at all; and

4) Briefly discuss why individual investors need to leave conventional financial wisdom behind and explore “outside

of the box” solutions to these pressing issues.

As discussed in Part One, someone

who had attended one of my inflation solutions workshops asked me to debate

deflation theory with him. I said “fine”

but with one condition: before I would

debate theory, he needed to first provide a real word example of this problem

actually having happened. Could he

answer this simple, real world question:

Name

an example of a modern, major nation where the domestic purchasing

power (as measured by CPI) of its purely symbolic & independent

currency uncontrollably grew in value at a rapid rate over a sustained

period, despite the best efforts of the nation to stop this rapid

deflation?

The two common answers to this question

are the United States during the 1930s (addressed in Part I) and modern

Japan. The Does Japan meet the

conditions of this central question?

Does it provide the real world “beef” for justifying theoretical monetary

deflation fears?

Clearly Japan and the yen meet the

criteria for modern, major, and symbolic.

How about the domestic purchasing power of its currency uncontrollably

growing at a rapid rate over a sustained period, despite the best efforts of

the nation to stop this rapid deflation?

After all, that is the very heart of the deflationist case for the US: that collapsing availability of credit will

shrink both the volume and velocity of money, creating a rapid, powerful

deflation that the government will be powerless to fight. Is that what happened in Japan? (Or anywhere else, ever, with a symbolic

currency?)

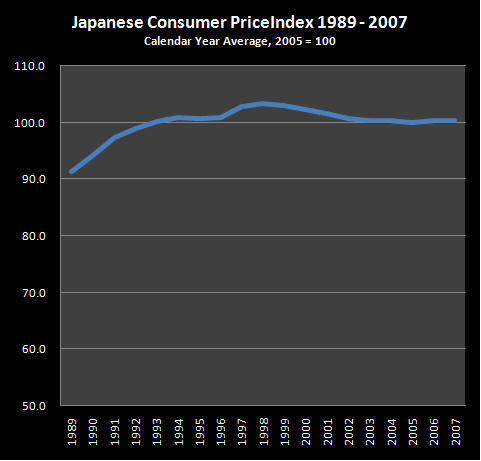

Maybe the best place to start is to see what actually happened to the domestic purchasing power of the yen during its time of economic “troubles”. The graph below tracks the average annual Japanese Consumer Price Index for the 19 year period from 1989 through 2007.

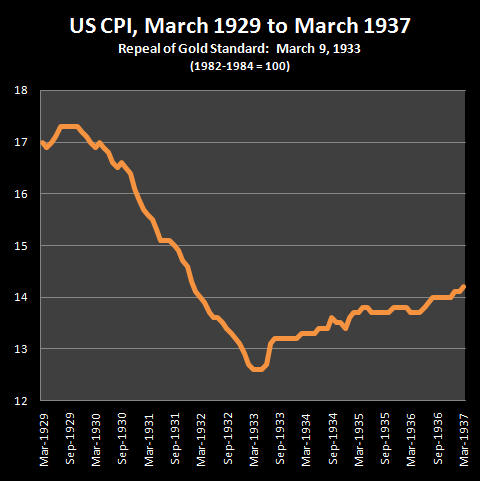

At first glance, that’s a pretty boring graph. Where is the drama and the action? Like that of the graph below from Part One of this article, which shows the US CPI during the Great Depression of the 1930s:

After looking at the US Consumer

Price Index from 1929 to 1933 (or most global currencies during that period),

the example of modern Japan looks quite tame in comparison. Where is the massive plunge? Where is that out of control monetary

deflation that Japan was powerless to stop?

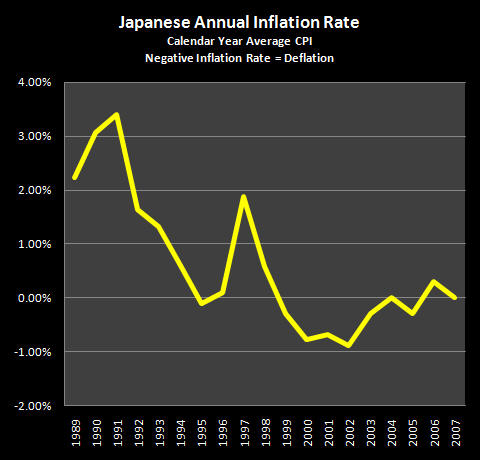

By historical standards, modern Japan clearly has not experienced major price deflation, not at all like the levels experienced by the US in the 1930s (and many nations at that time), or the bouts of severe deflation that hit repeatedly in the 1800s, when these nations were on a gold standard (as covered in Part I). Maybe this symbolic currency monetary deflation is there, but is hard to see? If it’s hard to see on a big graph with cumulative CPI, maybe we need to focus in and look at annual changes in the value of money:

When we look at the actual history

of price (CPI) deflation in modern Japan, we can easily see:

1) At its worst – Japanese price

deflation never reached even 1% per year, comparing average annual CPIs.

2) During the 19 years following the

crash of the Nikkei, there where only 6 years of minimal deflation, and 13

years of inflation.

3) On a cumulative basis over these 19 years, Japan experienced price inflation, not price deflation. Indeed, the domestic purchasing power of the yen fell by 9% between 1989 and 2007, as shown in the first graph, “Japanese Consumer Price Index, 1989-2007”.

When we put these three historical

facts together, then we have our fourth

common deflation fallacy (the first three fallacies are in Part One of this

series). This fallacy is the widespread

belief that Japan experienced powerful price deflation that it was unable to

combat. In fact – the rate of price deflation

never even reached one percent per year.

This was an almost infinitesimal amount, and even a slight change in the

calculation methodology could have led to no deflation at all. Also of importance is that arguably much or

even all of Japan’s minor “deflation” resulted from increasing imports of

cheaper goods from other nations, which has nothing to do with the collapsing

credit of deflationist theories. Falling

rents are the other main factor, but remove these imported goods, and the minor

deflation disappears. The New York Times

article from 2001, “Japanese Consumers Revel In Deflation's Silver Lining”, is

an easy-to-read treatment of what real world modern deflation was like at the

peak of Japan’s recent experience, that may be an eye-opener for many

readers.

This import driven (minor) price

deflation, which was also key in slowing inflation in the US in the same time

period (simply think China and Wal-Mart rather than esoteric macroeconomic

theory), is a very different “animal” from collapsing credit availability – and therefore irrelevant to proving

the argument. What also needs to be

clearly understood is that this deflation is not independent of government

policy, but is the direct result of government policy – the easing of import

restrictions to increase the size of the overall economy. Japan could have almost instantly stopped its

price deflation at will by simply changing import regulations.

Now granted, Japan has entered into

international agreements to allow freer access to its domestic markets, as has

the US, and there is the possibility that falling import prices from lower cost

nations desperately trying to escape their own depressions could exert

significant deflationary pressures in the future. But only if the governments let that

happen. These free trade agreements came

about because the developed nation’s citizens were assured economic prosperity

in exchange for effectively allowing the destruction of many of their domestic

industries. Replace promised prosperity

with actual depression, let the political cycle go around a time or two, and

import driven deflation is something that can and possibly will be stopped

immediately in many or most nations.

Because import driven deflation is not an unstoppable and independent

economic force, but a creation of the political process.

When we return to our question

asking for the single real world example of a symbolic currency rapidly

and uncontrollably gaining in domestic purchasing power, despite

the government’s best efforts to fight it – Japan clearly does not

qualify.

So, once again - where is that real

world example?

Do make sure you get an answer before betting your net worth on a theoretical argument about the inevitability of powerful and uncontrollable price deflation caused by a collapsing credit bubble, which governments will be powerless to fight.

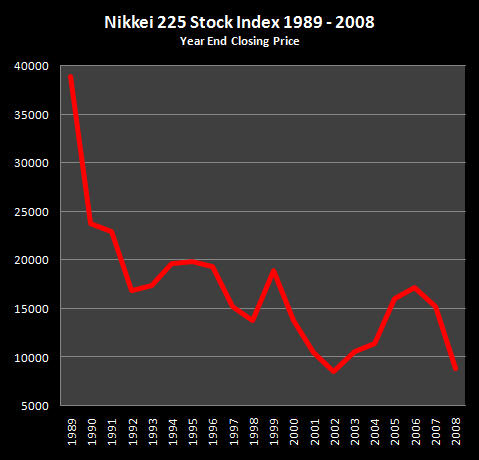

However, this is not to say that Japan hasn’t experienced powerful deflation over the last 20 years. Japan has indeed experienced major, even catastrophic deflation, that has savaged investor wealth and reduced the standards of living of many millions of Japanese as result – particularly the retirees. If you want to see a spectacular (and dismal) graph of Japanese deflation, here it is:

At the peak of the Japanese asset

inflation bubble of the late 1980s, both the stock market and real estate

market were hitting extraordinary highs, where the ability of companies to earn

profits, and the ability of homeowners to make mortgage payments, had become

almost irrelevant to stock and real estate prices. What mattered was price appreciation, and the

more insane prices grew, the more investors piled in, to enjoy the fantastic

paper profits that could be earned on the ride up.

That is, until the cycle turned, and the bubbles

popped. The Nikkei hit 38,916 by the end

of 1989 at the height of the exuberance – and then cold, hard reality started

to hit. The Nikkei fell to 23,848 in the

next year (down 39%), then 22,983 (down 41%), and then 16,924 by the end of

1992 (down 57% in 3 years). The full

fall took 13 years, with the Nikkei 225 reaching 8,578 by the end of 2002, a

78% fall - something investors in other nations who are tempted to go bargain

hunting today should keep in mind.

This is deflation of the very worst

kind for investors in general and retirement investors in particular – but it

isn’t price or monetary deflation. It is

something far more dangerous, and that is asset deflation.

Price deflation is about falling

prices for the goods and services you need to live and enjoy life. Because the prices for the things you need to

buy are falling – your money buys more,

meaning your real wealth is rising, all else being equal.

Asset deflation is about falling

prices for the substantive assets that you have – such as your house and your

investment portfolio. Because the prices

for which you can sell your assets are falling, your assets buy less, meaning your real wealth is falling.

Both deflations are about falling prices – but that is where the similarity ends. The two deflations have opposite direct effects on your standard of living. The direct effect of price deflation is to raise your standard of living, and the direct effect of asset deflation (assuming you are selling rather than buying) is to lower your standard of living. So really we are talking about two quite different kinds of deflation, which may have the opposite effects on their standard of living for many people.

Unfortunately, many financial

commentators don’t understand the difference between the two fundamentally

different kinds of deflation. This leads

to our fifth logical fallacy in this series, and a return to the basic problem

of comparing apples to oranges. In Part

I, the apples and oranges fallacy was taking a history of price deflation based

on gold-backed currencies, and saying it applies to purely symbolic currencies

– despite the radically different long term histories of the two different

types of currencies. Our fallacy in Part

II is mixing up two quite different types of deflation. This lack of differentiation leads to the mistaken

belief that Japan proves the case for modern

price or monetary deflation. It

doesn’t do anything of the sort – what Japan proves is the case for asset deflation – which is a quite

different thing.

This confusion of terms is a deadly

danger for individuals – and it really isn’t their fault. Economics professionals are of course well

aware of the difference between the two types of deflation. When you look at academic texts such as

“Deflation: Current and Historical

Perspectives” by Burdekin and Siklos (Cambridge Press), it is about modern asset

deflation, price deflation in the 1930s and before for gold-backed currencies,

and theories about whether monetary

deflation will return as a major danger.

This same structure, which quite explicitly distinguishes between historical

price deflation from the 1930s, actual modern asset deflation, and theoretical modern price deflation

dangers, also applies to such works as the

findings of the International Monetary Fund’s deflation task force, as reported

in “Deflation: Determinants, Risks and

Policy Options” (2003).

However, few people read such works

directly. Instead, the information must

pass through a filter, with the largest filter being the mainstream media. If the members of the media don’t understand

the difference – their readers and viewers certainly won’t either. Indeed, in a world where it is exceedingly

rare for the mainstream media to do something so basic and essential as report

stock indexes and gold prices in inflation-adjusted terms, it should come as no

surprise that the distinction between price deflation and asset deflation only

rarely appears. Which leads most people,

even very well read and highly intelligent people, to believe that there is

only one kind of deflation – a mistake that can have devastating consequences

for individuals and the value of their savings, as we will review in our sixth

fallacy.

This differentiation between asset

deflation and price deflation is very well understood by one particular group

of professionals – and those are Japanese economists. Kazuo

Ueda, Member of the Policy Board for the Bank of Japan, wrote an article

specifically to address the popular confusion about what was happening

in Japan, and the difference between general price and asset deflation. Here are two key quotes:

“There

is much confusion in popular discussion of Japan's deflation and associated

economic problems. This confusion tends to arise from a failure to distinguish

between three related, but different phenomena: the stagnation of the real side of the economy,

the deflation of general prices, and the deflation of asset prices. The

deflation of general prices has certainly persisted since the mid- or late

1990s, depending on the price index one looks at. However, the extent of the

price decline has been mild. The cumulative decline in the consumer price index

(CPI) since its peak in 1998 has been no more than about 3%.”

“Declines

in asset prices since the 1990s in Japan have been as large as they were during

the Great Depression.”

The implications of this long fall in asset prices are extraordinary for investors in the United States and other nations. Indeed one could argue that the financial planning and pension management industry in the US was based upon a mutual agreement by everyone involved to close their eyes and pretend that Japan didn’t exist, with the full complicity of the government and academic community. To discuss what happened in Japan, and the vital implications for the US and other nations at this time, requires another full article, which will be part 3 of this series.

Our sixth and most dangerous fallacy

is the widespread belief that deflation protects us from inflation. This belief is false and indeed constitutes a

deadly danger, because so many millions of people erroneously believe that

falling asset prices protects the spending power of their money.

On the face of it – deflation

protecting us from inflation looks so obvious, that it has to be true. If inflation and deflation are opposite and

opposing forces – how could you possibly have both at the same time? Common sense therefore tells many people that

as they read headlines about falling prices, one side benefit is that at least

for now, they can stop worrying about inflation.

Unfortunately, this is a false sense of security that is based on the mistaken belief

that there is only one kind of deflation, and that there is ample historical

proof for this type of deflation. The

common belief is that depressions generate monetary deflation, so inflationary

dangers at least temporarily go away.

Quite simply, this has never happened with a modern symbolic currency,

not in a way that meets the requirements of the question posed earlier in this

article. Collapsing credit availability

and the resulting collapsing money supply leading to an unstoppable and rapidly

rising value for a symbolic currency (price deflation) is a popular theory – but it has never happened in

the real world. (At its core the theory is

based on the naïve belief that a symbolic currency has some kind of inherent

value aside from the rules which the government sets up, or that governments

won’t change those rules when they have a strong incentive to do so. As discussed in my article “Why Inflation

Will Trump Deflation”, the power of a government to reduce or destroy the value

of its own symbolic currency is absolute.)

There is an extraordinary and well

proven danger from catastrophic deflation when leaving bubbles behind and

entering a depression or severe recession, but this deflationary danger isn’t

monetary deflation – it is asset

deflation. The core of the danger

is that asset deflation doesn’t provide protection against monetary

inflation. Instead, asset deflation and

price inflation have a long history of occurring simultaneously in economically

troubled nations, and working together to destroy wealth. Meaning that an investor who does not

understand the difference between the two types of deflation, and therefore

doesn’t maintain strong inflation defenses – is effectively “bare naked” as a

result. For just because the value of

your assets is plunging does not mean the value of your money is safe, not at

all.

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

Basing their financial strategies off of this false assurance, many people are failing to take protective

measures against inflation, even as they clearly see the Federal Reserve

creating money without limit in tandem with the US government creating bailouts

without limit.

When we look at collapsing credit and deflation – the relationship is very real and historically proven. Bidding up the prices of assets, or asset inflation, is often the result of cheap and easy credit financing the purchases of the assets. When the credit cycle tightens, then the lack of financing helps drive asset prices down, and a severe credit tightening like the current one can drastically drive prices down for a very long time. However, the combination of collapsing credit availability and the resulting collapsing asset prices leading to old-fashioned (gold standard type) major and unstoppable general price deflation – well, that is pure theory.

Let's re-examine the example of

Japan. If we look at the value of the stock market, when everyone had purchased

stocks in expectation of unending wealth, and that stock market is now down 80%

on an after-inflation basis - where is the protection? Even in the face of an 80% asset deflation in

real terms over a 20 year period, the Japanese yen is still worth less than when

the period of deflation started. The massive asset deflation obviously did not

protect the value of the currency.

It is also important to keep in mind

that Japan is a poor example of economic “troubles” – it is a nation of a mere

127 million people, lacking most natural resources, which managed to maintain its

position as the world’s second largest economic power for two decades of

“troubles” (before accounting for Chinese currency manipulation anyway). It is this continuing strong economic

performance (compared to the rest of the world) that accounts for Japan’s

currency losing so little of its value.

For another real world example of

how the value of the currency can fall simultaneously with the value of assets,

let’s look at the world’s number one economic power: the United States. The US hit a period of economic turmoil

between 1972 and 1982. The Dow stood at

929 in June of 1972, and by June of 1982 it had dropped to a nominal 812. It lost 13% of its value, and on the face of

it, this is an example of moderate asset deflation. However, something else happened between 1972

and 1982: the dollar lost 57% of its

value. When we adjust for inflation, the

Dow Jones Industrial Average actually dropped from 929 to about 350 (in 1972

dollars), meaning it lost 62% of its value (exclusive of dividends).

That 62% reduction in value is

powerful asset deflation – but here’s what that deflation and economic turmoil

didn’t do – it didn’t protect the value of the dollar. A 62% drop in the purchasing power of assets

did not protect the dollar from a 57% decline in its own domestic purchasing

power. The ability of powerful deflation

to protect the value of the currency failed spectacularly in practice.

Remember – the above is reality. A reality that has happened again and again in nations around the word that have gone through much worse economic stress than that experienced by the United States. Look at Iceland today. Or such well known examples as Argentina or Germany (or Zimbabwe) during their own bouts with high levels of inflation. In each case the purchasing power of assets was plunging simultaneously with the purchasing power of the currency. Which is exactly what you would expect for a nation in depression. The idea that going into a depression necessarily increases the value of that nation’s symbolic currency, when the currency is essentially backed by the economy, is a bit unusual when you think it through, and therefore the lack of historical precedents is not surprising.

Let’s quickly review the six

fallacies we have covered in Parts 1 & 2 of this article.

Fallacy

One.

The belief that a “dollar” is a “dollar” and that the deflationary

history of gold standard currencies applies to symbolic currencies (an “apples

to oranges” fallacy).

Fallacy

Two.

The belief that the US Great Depression proves the case for unstoppable monetary

deflation during depressions, when it in fact proves that a sufficiently

determined government can immediately break monetary deflation at will, even in

the midst of depression.

Fallacy

Three. The belief that inflation and deflation take

wealth from all of us equally, when what they actually do is redistribute the

wealth among us.

Fallacy

Four. The widespread belief that Japan experienced

powerful price deflation that the government was powerless to fight. It didn’t.

Fallacy

Five. The fundamental mistake of thinking that

“deflation” is “deflation”, which leads to confusing price deflation with asset

deflation, and means missing the real

lessons and dangers of what happened in Japan, which is the persistent asset

deflation that has defeated all government interventions (another “apples to oranges” fallacy).

Fallacy

Six.

The dangerous belief that deflation protects you from inflation. More specifically, the vocabulary confusion

that leads to the belief that asset deflation protects you from monetary

inflation, or that the destruction of the value of your assets is somehow

historically proven to protect the value of your money.

The six fallacies reviewed in this

and the previous article come as quite a surprise to many people. We uncovered those fallacies – by improving

our vision. Interesting though this is, better

understanding what has happened in the past is not the primary reason for

improving our inflation and deflation vision.

More importantly, improving our vision allows us take personal actions for the

future. As your vision improves further,

you will come to understand that what all forms of inflation and deflation

share is that they are redistributions of wealth among the individuals within a

society. When we raise the degree of

inflation and / or deflation, then we increase the opportunity for you have to

have wealth redistributed to you by these fundamental economic forces.

In contrast to the six fallacies – let’s consider what clear vision can look like:

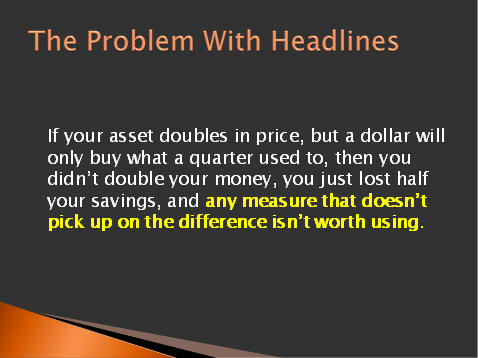

The above slide (from one of my

courses) is an illustration of simultaneous monetary

inflation and asset deflation. The one-two combination that annihilates

retiree wealth and the value of long term savings for other investors.

Now if you believe that it is simply

a matter of inflation versus deflation, and if you believe that all we're

talking about is the destruction of wealth, then it is all too likely that your

financial status in a situation like the above has been predetermined. You will

be a victim of inflation and a

victim of deflation. These forces acting in concert will take wealth away from

you, and it may seem almost impossible to stop them if you are in the common

situation of investing towards retirement and you have both substantial investment

and monetary assets to protect. Because the double forces of monetary

inflation and asset deflation will be working to simultaneously decrease the

purchasing power for both your money and your investment assets.

There is hope, however. Indeed there are ways to take the situation introduced in the slide, where the value of your money drops by 75% and the value of your asset drops by 50% - and turn that into substantial profits on a tax-advantaged basis. Possibly some of the best returns of your life on an after-inflation and after-tax basis.

You need to get out of step with

your generation, and have wealth redistributed to you even as your peer group

is being devastated by this extraordinary destruction of wealth. For this to happen, you need to start with an

essential and irreplaceable step:

education. You need to gain the

knowledge you will need to turn adversity into opportunity. This will mean looking inflation straight in

the eye and saying: “Inflation, you are

likely to play a big role in my personal future, and instead of ignoring you or

thoughtlessly flailing away at you – I will study you and your ways. I will learn the deeply unfair ways in which

you redistribute wealth, and the counterintuitive lessons about how some

investors will be destroyed by inflation and repeatedly pay taxes for the privilege,

even while other investors are claiming real wealth on a tax-free basis. I will learn to position myself so that you

redistribute wealth to me, and the worse the financial devastation you wreak –

the more my personal real net worth grows.

I will examine the official blindness to inflation within government tax

policy that creates the Inflation Tax, and instead of raging or despairing, I

will understand that a blind opponent is a weak opponent, and I will take

advantage of your blindness and use tax policy to multiply my real wealth.”

Remember – redistributions of wealth mean some people do worse – and other people do better. The higher the degree of inflation and/or the degree of deflation – the greater the redistribution of wealth. We are coming into a period of one of the greatest redistributions of wealth in our lifetimes, with extraordinary pressures building for both monetary inflation and continuing asset deflation (remember Japan’s fall in asset values lasted for 13 years). You have a choice to have wealth taken from you – or to find ways for wealth to be redistributed to you. To utilize that choice, you have to understand it fully, and all the nuances. Which means education. Otherwise, we’re just shooting in the dark.

Do you know how to Turn Inflation Into Wealth? To position yourself so that inflation will

redistribute real wealth to you, and the higher the rate of inflation – the

more your after-inflation net worth grows?

Do you know how to achieve these gains on a long-term and tax-advantaged

basis? Do you know how to potentially

triple your after-tax and after-inflation returns through Reversing The

Inflation Tax? So that instead

of paying real taxes on illusionary income, you are paying illusionary taxes on

real increases in net worth? These are

among the many topics covered in the free “Turning Inflation Into

Wealth” Mini-Course. Starting simple,

this course delivers a series of 10-15 minute readings, with each

reading building on the knowledge and information contained in previous

readings. More information on the course

is available at InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://InflationIntoWealth.com/

E-mail: mail@the-great-retirement-experiment.com

This essay and the websites, including the mini-course,

DVDs and books, contain the ideas and opinions of the author. They are

conceptual explorations of general economic principles, and how people may – or

may not – interact in the future. As with any discussion of the future,

there cannot be any absolute certainty. What this website does not

contain is specific investment, legal or any other form of professional

advice. If specific advice is needed, it should be sought from an

appropriate professional. Any liability, responsibility or warranty for

the results of the application of principles contained in the website, DVDs,

books and other materials, either directly or indirectly, are expressly

disclaimed by the author.

Copyright 2009 by Daniel R. Amerman, CFA